Ok, I have a confession. I’ve long been a bit bothered by how various “experts” propose you teach children about money. A very common way is to give a child money, say $30, and then divide that money up for them. One-third goes to savings, one-third to buying things, and one-third to charity, or whatever combination thereof. The reason I’ve been put off by this, I think, is because when I was a girl and given money, I saved everything. If you had told me to spend 1/3, save 1/3, give 1/3, etc., you would be encouraging me to spend, when my natural inclination was to save. You’d be giving me worse money habits. Telling children to do x, y, and z with their money, even with the best intentions about using that money “correctly,” is still controlling.

My financial education as a girl amounted to being amazed by coins in froggy banks; being given my own money, which I would go count often; and watching my parents both pay for everything in cash and pay down their debt. Honestly, I think this was a pretty good education. I remember being in awe and so proud when my mom said she paid off their house when I was eleven years old. I had never been introduced to compound interest, but I understood that paying off your house saved money in the long run and was a big deal. I grew up to be someone who was very financially disciplined. I had no inclination to spend beyond my means–this concept was outright foreign to me. I actually enjoyed wading through Excel sheets as I figured which loan I should pay off first. While some went upside down on their houses in the housing crash of 2008 or so, from my financial discipline and insistence that we pay off debt, we had paid enough of our house that we were still able to sell and move quickly when life called for it. Financial literacy gives you independence.

There are some areas where my financial education, I think, could have improved. And know that I think it is natural to have some gaps in education, but it is still on every generation to think of what could be improved for the next. I was somewhat lost when it came to stocks. The idea seemed simple, but I was lost in terms like “price-to-earnings ratio,” and it wasn’t due to lack of trying to understand it that I felt I didn’t. I was also a bit confused about how gold or silver worked as money in the past or if one should invest in it now. (I explained that to my children here, Teaching Your Children About Inflation.) And most of all, I wasn’t ready for how undisciplined and predatory people can be with money, and, more, how they pressure you into being undisciplined as well. With “stimulus checks” being all the rage in the past 20 years or so, people around me would proudly declare they bought the latest phone and thus did their patriotic duty to help the economy. Well, here’s me with my meager ideas about saving money and paying off debt. In the force of their snark and confidence, my young self didn’t know what I was up against. Now I do.

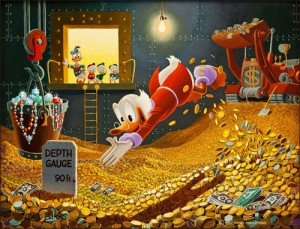

I think the best way to give children an education about money is to give them some and let them explore. I was given money in birthday cards, etc., and allowed to keep it, without being told what to do with it. I would go count this money off and on. It made me feel rich. I think this abundance mindset is more important than getting children to learn to “budget” at young ages, when they really shouldn’t need to be worried about that. (None of us do terribly well with financial insecurity, actually. Working well enough to make some money and otherwise living within our means should be the basic goal, without unnecessary worry after that.)

What I do with my children is I give them money of several different types. They have cash, locked in cash boxes. It’s theirs, no strings attached. We get them a silver coin for Christmas. We bought my son some stocks when he turned 10. I also plan on getting some government T-Bonds. All of this is just to give them some experience with all these different types of wealth. What does happen to the price of silver over time? We already figured out how much my oldest son, who has 10 coins so far, has from his silver. Will that go up by the time he is 18? You know, the answer has surprised us! (Silver is now down in price.) Oh, the lesson on stock is more than worth it. On one hand, sure, you might make quite a bit of money. On the other, you could lose money. And whatever lesson happens there, I think, is well worth it.

I took a course in college called Engineering Economy 101. It literally just went over compound interest. If Machine A can make 6% over the 20 years but costs [whatever] and Machine B…you get the idea. It was one of the few classes that I think proved worthwhile to my life after college. I also don’t understand why this wouldn’t be taught in high school. This is something I plan on doing with my children, at the high school level.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”–unknown

I also, however, want to give my children some perspective on wealth. Sure, you can save every penny and hope for a plush retirement. But life itself doesn’t usually lend to this perfect path. Stocks fall in price. Emergencies happen. And, more, locking up a lot of money for retirement might stop you from living some dreams now. Be smart about money–but live life.